Completing a Gift Aid declaration really helps us out. You can do this by:

1. Filling in this electronic form: NTSP Gift Aid Declaration Form

2. Setting up (or using your existing) PayPal account and telling PayPal that you would like to add Gift Aid.

If you use a PayPal account, this will keep a record of your donation for you (and your tax return if you need it) and for us. If you tell PayPal that you would like to add Gift Aid, then PayPal deals with HMRC on our behalf to top up your donation from the UK government. You can just donate right now using a credit or debit card if you prefer without setting up a PayPal account, but we would ask you to complete the NTSP Gift Aid Declaration Form if you are a UK taxpayer so that we can top up your donation by contacting HMRC ourselves. Even if you tell PayPal you want to add Gift Aid, it is still helpful for us to have the NTSP Gift Aid Declaration Form completed so we can track the donations.

If you don't want to add Gift Aid, or are not eligible, then you can still donate via the DONATE button at the top of the page.

There is a printed version of the Gift Aid declaration form available from the side bar of this page. If you prefer to download, print and fill in the form manually, that's fine with us! We need you to post or email it to us at the address on the form.

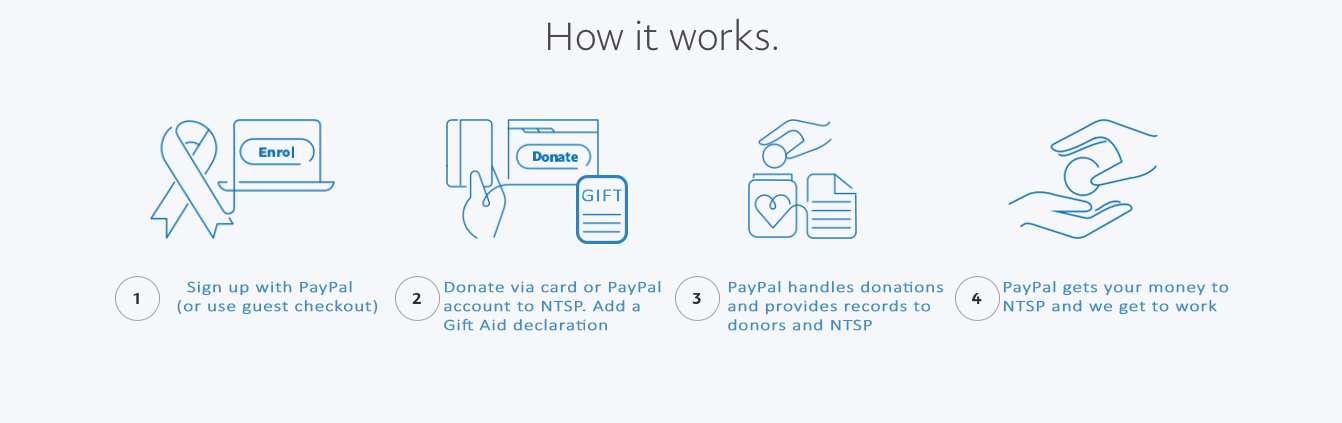

PayPal

Click this link to set up a new PayPal account if you don't have one already.

Then click this link to tell PayPal that you would like to add Gift Aid to your donations. As a charity, we use the PayPal Giving Fund to receive donations.

Return to this page and click the DONATE button at the top of the page.

It is helpful to us if you also complete a separate NTSP Gift Aid Declaration Form.

How does Gift Aid work?

The UK government has a scheme that allows Charities to claim an additional 25% of a donation from the government if the donor is a UK taxpayer. For example, if someone donated £100, the NTSP could claim an additional £25 back in Gift Aid. The donor does not pay anything extra, and in this example, the donor gives £100, and the charity receives £125.

Gift Aid is a government scheme that allows us to reclaim the basic rate tax you pay as a UK taxpayer. This is currently (in 2024) a claim 25p of tax for every £1 you donate at no extra cost to you. All you need to do is make a Gift Aid declaration. The declaration is completed as part of the donation process.

What if I am a higher rate taxpayer?

If you are a higher rate taxpayer in the UK, we’re still only able to claim the basic rate of tax on your donation. However, using Gift Aid can allow you to pay more of your tax in a lower tax bracket. You can claim the difference between the 20% we claim and the tax you pay when you submit your annual tax return. We cannot advise you about this, but you can add details of any Gift Aid donations to your annual tax return which may reduce the amount of tax you pay. You will receive a receipt from PayPal that details your donation and any Gift Aid for your records.

Do I need to make a separate Gift Aid declaration for each donation or to cover each tax year?

No, you only need to make a declaration once. We’ll keep this declaration as your enduring permission to claim Gift Aid tax relief on all donations to the NTSP. It will cover the previous four years, the current year and any donations you might make to the NTSP in the future.

Which donations qualify for Gift Aid?

Gift Aid can be applied to all voluntary donations of money, large or small, providing they are made by an individual who pays sufficient UK tax.

Your Gift Aid declaration will cover all cash, cheque, postal order, Direct Debit, standing order and credit or debit card donations. Gift Aid will not be applied to donations received from tax efficient payment schemes. These include Charities Aid Foundation (CAF) payments or payroll gifts, as tax relief has already been claimed. Cryptoassets are not eligible for Gift Aid.

The UK Government has a detailed website that explains about Gift Aid and Tax that you can view here.

Once completed, please remember to let the NTSP (or any other charities to which you have donated) know of any changes to your tax status, including changes to your name and address, so we can ensure that no further claims are made against your donations.

Do I qualify for Gift Aid on my donation?

To qualify for Gift Aid you need to:

- be a UK taxpayer

- have paid or expect to pay enough income or capital gains tax in the tax year your gift was received to cover all the Gift Aid donations you made to charity that year

- make a Gift Aid declaration

- ensure you paid enough tax to cover the donations you made in the previous four years if you are completing an enduring Gift Aid declaration (a declaration applied to future donations).

The basic rate of tax we claim is currently 20% on the gross value of your gift (that’s the same as 25% net). You must remember to let us know if your tax status changes in the future, otherwise you could be liable for any shortfall. You can contact the NTSP via the contact form here.

What if I stop paying tax? Can I withdraw the declaration?

This is only relevant if you plan on continuing to donate to the NTSP after you stop paying tax. You can cancel the declaration at any time by emailing your full name and address, including your postcode, to admin@tracheostomy.org.uk. Please do this as soon as possible.

I’m a pensioner. Do my donations qualify?

Income from state pensions alone is unlikely to qualify as you’d need to earn above the personal allowance threshold to pay income tax. If this is your only source of income, we advise that you check with your tax office before completing a declaration.

Is there any extra paperwork for me to complete?

No, but you may wish to keep a record of donations you make to charity in each tax year. If you have a PayPal account, your records will be held there. This will help ensure that you continue to pay enough tax to cover the payments you make under Gift Aid.

Does my declaration cover all donations I’ve ever made to you?

After we receive a Gift Aid declaration, we can go back and apply this (to claim the tax relief) on any donations made in the previous four years by the same person. If donations you’ve made go back further than four years, we’ll only apply the tax relief to donations within the allowed period.

What information does the NTSP keep about me and my donations?

In order to claim Gift Aid from the UK Government, the NTSP has to keep adequate records to demonstrate an audit trail to the HMRC. We are obliged to keep the minimal amount of data necessary to meet General Data Protection Regulations (GDPR). When you set up a PayPal account and donate or complete a Gift Aid declaration as part of a donation to us, PayPal will tell us some basic details about you. This includes your name, postcode and the date and amount of your donation. The NTSP has to keep this information in order to provide an audit trail to the Government about your Gift Aid declarations.

NTSP will not use these data to contact you. We will not pass these data onto anyone else. The only exception that we may be asked to pass information about our donations to the HMRC if the UK Government asks us for this information.

PayPal will also keep this information about you. You can read about PayPal’s data storage in their terms and conditions.